The Best Payroll Services of 2024

Choosing the Right Payroll Services

Rippling Payroll Review

This payroll company is also growing. It added 62 percent more employees in the past six months and has raised nearly $200 million in funding. Its product goal is to automate routine tasks so business owners and leaders can spend more time doing the “actual work,” like building their company.

-

Max Speed

Flight Time

8.2

Ripling Payroll Service Review 2023

Rippling is a top payroll service for growing companies needing to move to an integrated payroll system. Its employee platform can help businesses integrate payroll, HR, IT, and LMS. Smaller companies can easily start with payroll and add other services as they grow. Price

8.2

Customer Service

9

Payroll Standard Features

9.5

Payroll Add on Features

6.5

Reporting

7.5

Time in Business

7.7

Other Expert Ranking

7

PROS:

- Low-cost entry level plan

- 100s of integrations

- Local and PEO services available

CONS:

- Limited telephone support

- Time consuming implementation

- Add-ons add up quickly

SunTrust Payroll Service Review

Using Suntrust, you can save nearly 20 hours of work time per month and avoid costly and embarrassing payroll errors. If you employ household workers, this online payroll service will help you stay compliant and avoid expensive tax filing mistakes.

-

Max Speed

Flight Time

7.9

SunTrust Payroll Service Review 2023

SunTrust is specifically created to help small business owners and those who support household workers. This payroll processing service is owned by the second largest payroll processing company, Paychex, Inc. SurePayroll has processed over 20 million payroll runs and calculates payments for over 6,000 different taxes. Price

7.9

Another Rank

7.9

PROS:

- SunTrust is a prominent financial institution in the United States.

- SunTrust provides business owners with the Small Business Resource Center, which is full of valuable resources and information.

- SunTrust provides business owners with a wealth of other services aside from payroll, which may be worth your consideration.

CONS:

- Since SunTrust is not a dedicated Payroll company, you may not receive the benefits or features of such a company.

- There is no mentioning of prices, rates, or fees on their website.

ADP Payroll Review

While the program maybe difficult to learn, once you master how ADP Enhance Payroll’s ADP RUN works, you will never have to think about payroll or taxes again.

-

Max Speed

Flight Time

8.6

ADP Payroll Service Review 2023

One of the most widely used payroll service company and service in the United States is ADP Essential Payroll. This workforce management service company has risen to the top of the class given its comprehensive solutions for business owners. With ADP, business owners, of any size company, can take care of payroll and tax services with their all-in-one program. In this article, we are going to explore ADP and see if the hype is worth your future business investment. Price

7.7

Customer Service

9.5

Payroll Standard Features

9.5

Payroll Add on Features

7.7

Reporting

8.5

Time in Business

9.7

Other Expert Ranking

8.7

PROS:

- ADP Enhance Payroll does not charge fees for payroll services for employees in multiple or different states, making this a great company for larger multi-state companies.

- ADP Enhance Payroll is one of the most comprehensive services available to businesses today.

- Business owners have access to both payroll and tax services with ADP RUN.

- ADP Enhance Payroll has won numerous awards as one of the best online payroll services for business owners.

CONS:

- Unlike many other major payroll companies, ADP does not provide business owners with an account specialist.

- ADP Enhance Payroll Service programs are not user-friendly and make require some time to learn how to use.

Paychex Payroll Review

The best part about Paychex is their 24/7 customer service support, which is quite rare considering even the best of the best payroll companies do not provide such service.

-

Max Speed

Flight Time

8.9

Paychex Payroll Service Review 2023

There are not many companies that can compete with the streamlined process of Paychex Payroll Service. This company has risen to the top of the payroll industry as one of the best online payroll services because of it’s unique features, fast payroll process, and user-friendly nature. Aside from the minor fees for processing W-2 forms and 1099s, Paychex is most certainly worth your company’s consideration. Price

8.2

Customer Service

9

Payroll Standard Features

9.5

Payroll Add on Features

8.7

Reporting

9

Time in Business

9.5

Other Expert Ranking

9

PROS:

- Paychex Payroll Services offers 24/7 customer service support.

- Paychex system allows employees to access their personal information through the self-service portal and application.

- Paychex’s system makes payroll easy and only a few easy steps, which may be beneficial for business owners that are not tech savvy.

CONS:

- You will be charged a fee to process any 1099 or W-2 forms.

- Paychex is a more simplistic payroll service and may not offer all the bells and whistles of more prominent companies.

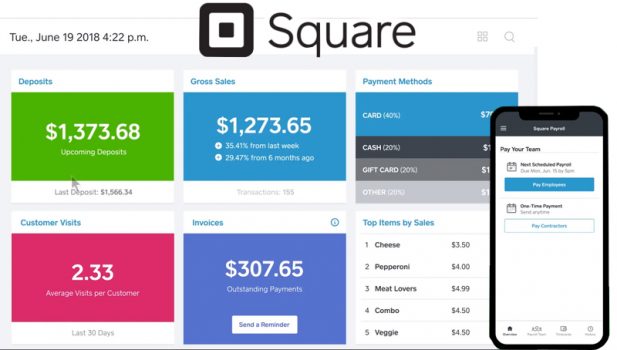

Square Payroll Review

Most business owners have heard of this business before – but perhaps not their payrolling features.

-

Max Speed

Flight Time

8.5

Square Payroll Service Review 2023

On our journey to find the best payroll service provider, we have stumbled across a new contender that appears to have a strong argument to be the best: Square Payroll. Most business owners have heard of this business before – but perhaps not their payrolling features. Let’s see what their payroll processing services are all about. Price

8

Customer Service

9

Payroll Standard Features

9.5

Payroll Add on Features

7.7

Reporting

9

Time in Business

8.2

Other Expert Ranking

8

PROS:

- Square Up offers business owners a free-up and plans starting out as cheap as $5 a month.

- Square provides business owners with a wealth of different payroll processing features.

CONS:

- Some business owners may not find Square Up’s payrolling system beneficial for them.

SurePayroll Review

Using SurePayroll, you can save nearly 20 hours of work time per month and avoid costly and embarrassing payroll errors. If you employ household workers, this online payroll service will help you stay compliant and avoid expensive tax filing mistakes.

-

Max Speed

Flight Time

8

SurePayroll Payroll Service Review 2023

SurePayroll is specifically created to help small business owners and those who support household workers. This payroll processing service is owned by the second largest payroll processing company, Paychex, Inc. SurePayroll has processed over 20 million payroll runs and calculates payments for over 6,000 different taxes. Price

7.7

Customer Service

9

Payroll Standard Features

9.5

Payroll Add on Features

6.5

Reporting

7.5

Time in Business

8.7

Other Expert Ranking

8

PROS:

- Need Pros

CONS:

- Need Cons

Intuit Payroll Review

Intuit Full Service Payroll is known around the United States as the one of the best payroll services in the country.

-

Max Speed

Flight Time

8.7

Intuit Quickbooks Payroll Service Review 2023

Intuit Full Service Payroll is clearly a full-scale payroll company, offering a great and feasible payroll option for business owners. It’s clear that this company has been named one of the best companies on the market for a reason. Price

8

Customer Service

9

Payroll Standard Features

9.5

Payroll Add on Features

8.7

Reporting

9

Time in Business

8

Other Expert Ranking

8.9

PROS:

- Intuit Payroll Services comes with error-free guarantee when handling employee checks and taxes.

- Intuit offers one of the most comprehensive payroll service packages available for business owners.

- Intuit Payroll services will help set-up and establish your company’s payroll system.

CONS:

- Intuit Full Service Payroll does not come with 24/7 customer support.

- This service may not prove useful for larger companies.

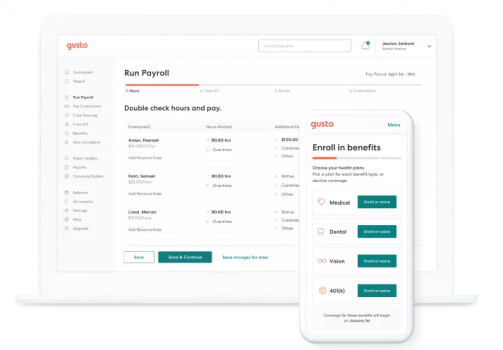

Gusto Payroll Review

Gusto is a extremely popular platform for business owners to outsource their payrolling and has even been named one of the best platforms online today.

-

Max Speed

Flight Time

9.2

Gusto Payroll Service Review 2023

When it comes to the payrolling industry, there are not many companies out there like Gusto. Gusto is a extremely popular platform for business owners to outsource their payrolling and has even been named one of the best platforms online today. With that being said, we have decided to review this company to see what they are all about. Are you ready? Price

8.5

Customer Service

9.5

Payroll Standard Features

9.5

Payroll Add on Features

9.5

Reporting

9.5

Time in Business

8

Other Expert Ranking

9.2

PROS:

- According to numerous surveys, and their website, Gusto has been said to be easier to use than any other payrolling platform or solution.

- Gusto Payroll Services provides business owners with a comprehensive full-service payroll features.

- You can find all the information you need on their website, including fees and prices at gusto.com

- Business owners may sign up for a one month free trial.

CONS:

- No mobile app

- Gusto is a newer company

- No Geo tracking for time tracking

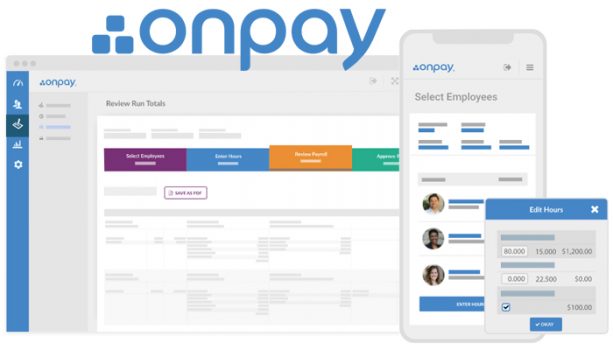

Onpay Payroll Review

OnPay online payroll service is, without question, a strong payroll program for small business owners.

-

Max Speed

Flight Time

8.8

OnPay Payroll Service Review 2023

Today, there are dozens of programs and software that are designed to help manage and control a company’s payroll and tax services. An example of this is a prominent and nationally-recognized company, OnPay Payroll Services. We are going to explore this top-rated payroll service company and decide whether this company is worth your consideration. Price

8

Customer Service

9

Payroll Standard Features

9.5

Payroll Add on Features

8.7

Reporting

9

Time in Business

8

Other Expert Ranking

8.9

PROS:

- OnPay Payroll Service provides business owners with a tax accuracy guarantee. This way, business owners are ensured this program will handle a company’s taxes with no errors or mistakes.

- OnPay Payroll Service offers a quick and speedy payroll service, ensuring all employees are paid on-time and accurately.

- OnPay provides a wealth of payroll features at considerably affordable monthly costs.

CONS:

- To utilize OnPay’s direct deposit feature, business owners will need to pay a monthly fee.

- OnPay will also charge a nonmail fee to process W-2s and 1099 forms.

- Whenever a company hires a new employee, OnPay has a new reporting fee.

Patriot Payroll Review

Small company owners often "wear many hats," and payroll is just one more. Patriot payroll services help you automate your payroll so you can free up your time to run and grow your business.

-

Max Speed

Flight Time

8.2

SurePayroll Payroll Service Review 2023

SurePayroll is specifically created to help small business owners and those who support household workers. This payroll processing service is owned by the second largest payroll processing company, Paychex, Inc. SurePayroll has processed over 20 million payroll runs and calculates payments for over 6,000 different taxes. Price

8.7

Customer Service

9

Payroll Standard Features

9.5

Payroll Add on Features

7

Reporting

7

Time in Business

8.7

Other Expert Ranking

8.5

PROS:

- Need Pros

CONS:

- Need Cons