Square Payroll Review

Most business owners have heard of this business before – but perhaps not their payrolling features.

$34.00

Square is a leading payroll processing service

It would be hard-pressed if you’ve never had an interaction with a Square product. It supports millions of customers. Its best known for its POS and payment processing services. Millions of merchants use Square to process payments. It was one of the first to offer easy-to-use payment processing using a mobile phone or tablet.

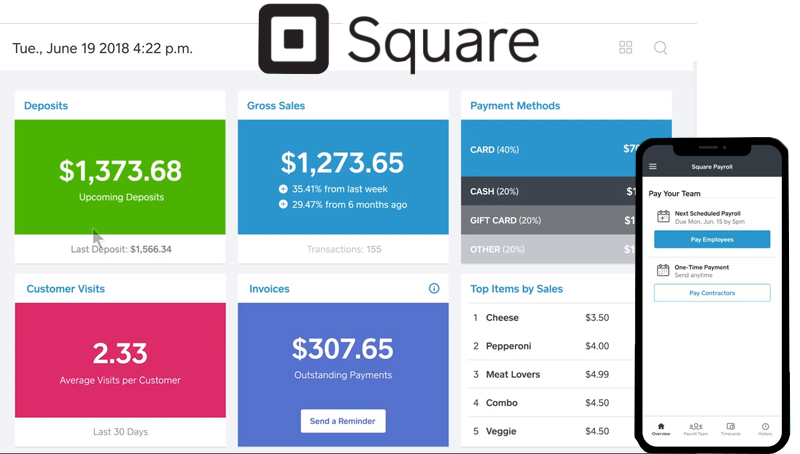

Square offers numerous business products, including a fully integrated payroll processing solution. Its payroll processing services work with its POS systems to help small businesses accurately process payroll for retail, restaurants, professional services, and counter-serve businesses. The POS service provides tools for tracking employee information, clock-ins, schedules, tip and commission data, and PTO and holidays to help businesses produce accurate payroll.

The payroll processing service includes many features businesses need, such as automated local, state, and federal tax filing, unlimited payroll runs, tip and commission tracking, direct deposit payments, workers ‘compensation support, mobile apps, and more.

What is a Payroll Service?

Payroll services help businesses accurately process payroll for hourly employees, contract workers, salary-based employees, and tipped or commissioned employees. It relieves the business owner or accounting team from manually configuring tax and benefit deductions and processing hours-worked and PTO/holiday pay.

Most payroll services quickly pay employees by direct deposit, check, pay card, or payment app. The best payroll companies support unlimited payroll runs, which means you can process payroll weekly, bi-weekly, twice per month, or other for the same low monthly rate. It also means you can process other types of payments such as bonus checks, holiday pay, termination pay, or severance payments without having to pay extra.

To help produce correct payroll payments, payroll services integrate with time tracking scheduling solutions. It may integrate with 3rd party solutions or provide its own. Often mobile time tracking apps are provided as well. It also may integrate with its own or 3rd party accounting or human resource solution.

Most payroll services include the following features:

- Payroll processing for W-2 and 1099 workers

- Check and direct deposit payroll payments

- Employee tax configuring and reporting

- Tax filing support (may cost extra)

- Healthcare and retirement withholding

- Employee self-service tools, including mobile

- Reporting features

- Garnishment withholdings

- Time and schedule tracking (may cost extra)

- Tax and employment law compliance support

What businesses are best served by Square Payroll?

Square Payroll is ideal for those looking to add payroll processing to Square POS, new businesses needing a range of business products to help them run and promote their business, or companies looking for integrations with key business products.

If you started out small using Square POS and payment processing but have grown and now need to manage employees, it’s a good time to consider Square Payroll. It integrates with your exiting Square POS tools, and you can easily add features as your business grows.

New businesses looking for an affordable all-in-one solution will appreciate Square’s integrated business tools such as POS, payment processing, payroll services, marketing tools, eCommerce tools, delivery and order features, scheduling and time tracking, inventory tools, basic customer relationship management, touchless payments, and reporting tools.

Due to Square’s popularity, demanded integrations are continually being created. For example, the ordering system is compatible with DoorDash, Uber Eats, Chowly, and Postmates. If you work with other popular apps, Square may be an excellent fit to help you manage your business.

Square services are particularly suitable for retail, restaurant, seasonal businesses, eCommerce, professional services, cafes, coffee shops, bars, spas and salons, quick service food, and health and fitness. Customized enterprise services are also available.

Square supports businesses in all 50 US states and the District of Columbia.

What services does Square Payroll offer?

Square offers payroll services that fully integrate with its other business tools such as point-of-sale and payment processing. Service price is easily manageable since it charges a flat fee and does not charge additional fees per feature. It also supports unlimited monthly payroll runs.

Square is an affordable payroll option for small businesses, especially if used alongside other Square products. The cost for running payroll for a company of ten employees costs just $79 per month, regardless of the number of payroll runs.

Payroll Employees and Contractors: $29 plus $5 per employee per month

- Account setup support

- Employee and manager apps

- Healthcare and retirement benefits available

- No long-term contract

- Pause for seasonal inactivity

- Payroll service

- Payroll tax deductions

- Pays by direct deposit, check, or Cash App

- Quarterly and annual tax filing

- Timecards

- Tracks tips and commissions

- Unlimited payroll

- W-2 and 1099 form support

- Workers’ compensation insurance

Contractor Only Plan: $5 per month per person paid

- 1099 form support

- No contract required

- Pause for seasonal inactivity

- Pays by direct deposit, check, or Cash App

- Unlimited pay runs

Square Payroll Features and Benefits

Square offers payroll processing as a standalone product or as an integrated companion with other Square business solutions.

Payroll processing

Square payroll service helps businesses of all sizes process payroll for employees, contractors, tipped workers, and commission-paid employees. Its payroll processing fees are affordable, and Square provides flat pricing, eliminating “surprise” fees at billing time. It supports unlimited payroll runs per month and doesn’t require a long-term commitment.

It pays employees by direct deposit, check, or via the Cash App. If paying by the Cash App, employees can request “on-demand pay” and get paid a part of their check before payday.

Benefits and deductions

Square processes deductions for benefits such as workers’ compensation, healthcare payments, retirement benefits, and court-ordered garnishments. Specifically, it processes deductions for HSA, FSA, IRA, 401(k), dependent care flexible spending account, 403B, and 457(b) benefits.

Tax compliance

This payroll service calculates, files, and pays federal and state payroll taxes. If you’ve been doing this manually, you know how time-consuming it is to manage taxes. It processes taxes for W-2 and 1099 workers. Square can even process special amounts, for example, if an employee wants to pay an extra amount per check towards their taxes. It makes tax payments directly from your business banking account. Many payroll services offer these features as an upgrade, but Square includes it with all payroll plans.

Timecard and scheduling

Processing accurate payroll requires accurate time reporting. Square provides simple team management tools for tracking hours, or it also works with other time tracking systems. The Square system tracks hours, sales, PTO, sick pay, and permissions. It also directly connects to the time tracking features included with the POS system. Or it can pull data from solutions such as Deputy or When I work.

Ease of use

While this may not be a “feature” per se, it should be mentioned. Square software is incredibly simple to use. The learning curve for managers and employees is minimal. Some say it is as “easy as an iPhone” to use. Software that is hard to use increases training time, entry mistakes, implementation time, processing time, and payroll errors. Ease of use matters when it comes to deciding the best payroll software to purchase.

Square Payroll pros and cons

Even though Square is an extremely popular POS and payroll solution, it’s still relevant to review the pros and cons to evaluate whether it is a good fit to meet your specific payroll processing needs. An overall thing to consider is that Square payroll works best with other Square products. However, if you already use Square payment processing and POS, adding this service may be a great option for you.

| Square Payroll Pros | Square Payroll Cons |

| Unlimited payroll runs | Minimal reporting |

| No long-term agreement required | Limited integrations with non-Square software |

| Easy to use | One-on-one support limited |

What are some of Square Payroll greatest strengths?

Square Payroll’s greatest strengths include how easy it is to use. New business owners or new hires can quickly figure out how to navigate Square software with minimal training. Another standout ability is that it integrates with its POS and payment processing services to help make it a complete business solution for many SMBs.

Simplicity

Square products are easy to use, especially if you compare its interface to traditional POS, payment processing, or payroll systems. The interface is streamlined and uncomplicated. Help information is simple to find if you need it. You do not need to have prior experience to use most Square solutions.

Affordability

Square solutions are affordable for all sizes of businesses. If you have 50 employees, it will only cost your company $279 per month regardless of how many times you run payroll per month. Some services charge per payroll run and may charge more per feature. If you only have to pay contract workers, it’s just $5 per month per each.

Tax filing

This payroll service automatically calculates, withholds, and pays federal and state tax agencies. This feature alone is super valuable as it helps businesses stay compliant and avoid tax issues.

Integrates with other Square services

Square offers a long list of business products, and its payroll service is a good addition to them if you are already using Square solutions. Fully integrated solutions significantly reduce stress and help speed up implementation times while also decreasing training and adoption times.

What makes Square Payroll unique?

What makes Square standout as a payroll solution is that it works incredibly well with its extremely popular (and easy to use and affordable) POS and payment processing systems. Businesses that already use Square for other business services will find it easy to add its payroll processing service. Plus, Square’s payroll processing solution is affordable, even for small operations.

In addition, unlike some payroll processing services, you can use Square as a standalone service. While it is compatible with Square business products, you do not have to be a Square customer already to use this payroll service.

What makes Square Payroll a top payroll service provider?

In many ways, Square revolutionized payment processing. It bought simple payment processing to all types of businesses, even those that just needed mobile seasonal payment processing. It also provides affordable tablet-based POS, which won many customers over. If you add to this affordable payroll processing, Square stands out as a low-priced option for small business owners.

Before products like Square small business owners were paying thousands of dollars for expensive POS hardware and payment processing. Not only that but they were also required to sign long-term contracts, often multiple-year lease contracts. New business owners often struggled to make POS payments when their business was new, small, or even failing. Using Square, small business owners can afford to take a chance on a new or short-term business.

That said, Square also provides options for large businesses and franchises. One arena it has particularly found success in is large events such as sporting events, fairs or carnivals, conventions, and music festivals. This is because vendors do not need to sign a long-term contract, its mobile. and the contract can be paused until the next event occurs.

What integrations does Square Payroll offer?

Square Payroll seamlessly integrates with other related Square products. However, Square products integrate with numerous other business solutions as well, either partially or fully. A partial integration may be the ability to simply exchange information. Full integrations can exchange multiple data points and may be able to share multiple data points automatically.

The Square App Marketplace lists hundreds of integrations. We considered the integrations especially related to payroll processing. However, other integrations are also available that support eCommerce and POS processes such as inventory control, appointment setting, delivery orders, and invoicing.

Accounting and tax apps:

- Bench

- Bookkeep

- FreshBooks

- Hurdlr

- QuickBooks Online

- SAP Business One

- TaxJar

- Xero

- XOHO Books

Point of Sale:

- Aireus

- Bend

- franPOS

- OrderUp

- Shopwave

- SuitePOS

- TouchBistro

Team management and Scheduling:

- 7Shifts,

- Deputy

- Homebase

- Humanity

- TipHaus

- When I Work

- ZipRecruiter

Does Square Payroll offer data migration from other providers?

Square imports data from customer profiles, other POS systems, accounting and invoicing software, payment processors, ecommerce products, shopping cart software, and more.

Some data migrations tools are created by Square, others are created by 3rd party developers. Square development tools are available.

Regarding payroll software, it can import data from popular payroll solutions such as:

- ADP

- Excel, PDF, or CSV files

- Gusto

- Heartland Payroll

- Paychex

- QuickBooks Online

- SurePayroll

What is Square Payroll security and reliability?

Since Square is a payment processor, it invests heavily in security and compliance. It publishes its complete Terms, Security Policy, and Privacy Policy. Square is not in the position to slack on security. It couldn’t stay in business if it did since it manages payment information, customer data, business information, and employee information.

Physical and server security

The most secure payroll processors don’t just provide encryption protection, but they also provide physical security to hardware devices such as physical servers. Square protects by,

- Encrypting data stored on servers

- Encrypting data collected by card readers

- Utilizes SSL and PGP technologies

- Employs 128-bit cryptographic keys and 2048-bit asymmetric keys

- Restricted technology and human access to data

- PCI compliant

Organizational security

This security concerns access, monitoring, and auditing.

- Restricted access to sensitive data

- Two-factor authentications and regulated password control

- Routine security testing and auditing

- All access is monitored and logged

- Security policies and procedures and communicated and routinely reinforced

- Incident responses and are logged and quickly responded to

Square Payroll financial position

Square (NYSE: SQ) has been a publicly-traded company since 2015, at the time, its evaluation was $2.9 billion. Its current evaluation is over $100 billion USD. Its CEO cofounded Twitter and Square. Square was founded in 2009 and has grown exponentially since.

Recent revenue increases have been attributed to its ability to process Bitcoin via Cash App and the increased adoption of contactless payment processing in reaction to COVID-19.

Resources about Square Payroll

Square publishes volumes of support information, including a blog, guides, community, events, podcasts, a YouTube video channel, social media profiles, and more.

- Check out Square’s latest news and press releases

- Review webcasts and events

- Financial and investor information

- Square maintains an active blog containing volumes of information for SMBs

- Guides to using Square products

- The Square Seller Community

- Interested in working with Square? Review the affiliate program.

- Visit the Square YouTube channel

- Interact with Square via Facebook, Twitter, or Instagram

- Square also support a podcast channel

For more information about Square Payroll

There are many ways you can contact Square. If you are interested in learning more about Square’s products and services, you can submit a web query for immediate response or contact sales by calling 1-855-700-6000. For general information, you can submit your information here via instant chat.

If you are an existing customer, you can contact Square by telephone, email, or chat.

Specification: Square Payroll Review

| How other 3rd Party Experts Rank each product (Bronze, Silver, Gold) | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||

| Price | ||||||||||||||||||||

|

||||||||||||||||||||

| Customer Service | ||||||||||||||||||||

|

||||||||||||||||||||

| Payroll Standard Features | ||||||||||||||||||||

|

||||||||||||||||||||

| Payroll Add on Features | ||||||||||||||||||||

|

||||||||||||||||||||

| Reporting | ||||||||||||||||||||

|

||||||||||||||||||||

G2 Reviews –

Here is a summary of the user reviews that people found most helpful. They were voted as most helpful for both positive and negative reviews out of the 24 available to read on G2 Reviews.

Most helpful: Positive Review (full review) Most helpful: Negative Review (full review)

Capterra Reviews –

Here is a summary of the user reviews that people found most helpful. They were voted as most helpful for both positive and negative reviews out of the 549 available to read on Capterra Reviews.

Most helpful: Positive Review (full review) Most helpful: Negative Review (full review)

Software Advice –

Here is a summary of the user reviews that people found most helpful. They were voted as most helpful for both positive and negative reviews out of the 549 available to read on Software Advice Reviews.

Most helpful: Positive Review (full review) Most helpful: Negative Review (full review)