Intuit Payroll Review

Intuit Full Service Payroll is known around the United States as the one of the best payroll services in the country.

$22.50

QuickBooks Payroll: Market Leading Payroll Services

QuickBooks Payroll services help businesses stay compliant and pay employees easily. Intuit’s QuickBooks has been helping businesses with accounting, taxes, and payroll since 1983. While the “real” number is difficult to track down, some estimate that QuickBooks has an 80 percent market share for small and medium-sized businesses within the US. QuickBooks Payroll is a simple add-on to QuickBooks Online.

Payroll is one of the most significant expenses for small businesses, so it needs to be processed accurately. It is also critical for employee taxes to be filed and paid correctly to help keep companies out of hot water with the IRS. QuickBooks Payroll helps business owners, accountants, and HR team members efficiently process payroll and files employee taxes for salary, hourly, and contract workers.

While QuickBooks has many emerging competitors, it is still one of the top payroll processors. To stay competitive, it has (for the most part) moved entirely online and has added mobile abilities. Additionally, in the past ten years or so, they have continually worked on ease of use and its UX to meet the needs and expectations of new users.

What is a Payroll Service?

Payroll services help businesses process payroll accurately and calculate the required local, state, and federal payroll taxes. Managing payroll processing and calculating employee taxes allows business owners or their accountants to free up resources for other operations. Most business owners and accounting team members report that services such as QuickBooks Payroll saves them many hours of work per week.

Payroll services most often do not work alone. Usually, they connect to compatible accounting and human resource solutions. However, some offer a few extra tools that may be enough for small operations to function without additional services.

Payroll services typically include the following features:

- Benefits withholding

- Employee mobile app

- Employee tax configuring and reporting

- Employee tax filing support

- Garnishment and specialized withholdings

- Paper check, direct deposit, or debit card payroll payments

- Payroll processing for hourly, salary, and contract workers

- Reporting tools

- Tax and employment law compliance support

- Time and schedule tracking

What businesses are best served by QuickBooks Payroll?

QuickBooks Payroll is suitable for small or med-sized businesses such as nonprofits, restaurants and hospitality, construction, retail, and professional services. An accountant version is available for those who provide financial services.

Please note that QuickBooks Payroll was previously known as Intuit Online Payroll up until May 2021. By the end of 2021, all Intuit Online Payroll customers will need to move to QuickBooks Online Payroll.

What services does QuickBooks Payroll offer?

QuickBooks Payroll works with other QuickBooks products. Three plans are available that support small and growing businesses. Each plan includes Payroll Core.

Payroll Core includes:

- Unlimited payroll runs

- Automated tax forms

- Calculated payroll and taxes

- Employee online portal

- Processes deductions

- Reports

- Support in all 50 states

QuickBooks Payroll plans

QuickBooks Online Payroll Core: $45 plus $4 per employee per month

- Full-service payroll

- 1099 filing and pay

- 401(k) plans

- Auto payroll

- Automated forms

- Health benefits

- Next-day direct deposit

- Product support

QuickBooks Online Payroll Premium: $75 plus $8 per employee per month

- HR support center

- Same day direct deposits

- Time tracking

- Workers’ compensation support

QuickBooks Online Payroll Elite: $125 plus $10 per employee per month

- 24/7 product support

- Personal HR advisor

- Project tracking

- Setup support

- Tax penalty protection

QuickBooks Payroll Features and Benefits

QuickBooks Payroll provides the tools needed to help small and medium businesses calculate, process, and pay payroll. Even the most basic plan provides sufficient tools for small operations to process unlimited payroll easily. The payroll app is simple to use, and you can have your company and first employee set up within minutes.

QuickBooks Payroll standout features:

Automatic payroll processing

The main job of this type of service is automated payroll processing. QuickBooks Payroll tracks hours and holidays, calculates deductions and taxes, manages notifications and approvals, makes payroll payments, and supports 1099 workers to help businesses process payroll accurately and quickly. And, unlike some payroll services QuickBooks supports unlimited payroll runs, which means that the monthly rate is the same no matter how many times you process payroll per month.

Calculates, files, and pays taxes

QuickBooks Payroll automatically calculates, files, and pays state and federal employment taxes for you. It can help with quarterly taxes and year-end filings. It keeps track of tax law changes, so you don’t have to. If they make a calculation error, they may pay up to $25,000 if you receive a payroll tax penalty. This alone takes a lot of stress away from your accounting or HR team.

Process benefits and deductions

Intuit offers retirement and healthcare options and processes deductions for benefits and more. For example, it can manage deductions for 401(k) contributions, healthcare premiums, court-ordered garnishments, and unique deductions such as gym fees.

Time tracking

Basic time tracking is included with the Premium or Elite versions of QuickBooks Payroll. You can add more advanced time tracking and scheduling features by adding QuickBooks Time. QuickBooks Time is available in two versions: Premium and Elite. This tool can track time via a mobile app, the web, or time clock kiosk. This app tracks time, schedules, projects, mileage, and jobs. QuickBooks Time is suitable for those who employ in-house and offsite workers. Features that support offsite workers include GPS tracking and geofencing.

Customer support

QuickBooks Payroll plans come with 24/7 chat support and telephone support during extended business hours. If you’d rather not use the chat service, you can request a scheduled support telephone call. DIY support is available online in the form of support resources, a community form, video tutorials, webinars, and training classes.

QuickBooks Payroll Pros and Cons

Intuit software provides two of the most popular financial products in the US, TurboTax and QuickBooks. However, that doesn’t always mean it is the best product for you. Quickly reviewing QuickBooks Payroll’s pros and cons can help you see if this solution may be suitable for processing your business’s payroll.

| QuickBooks Payroll Pros | QuickBooks Payroll Cons |

| Unlimited pay runs | Cost of upgrades add up quickly |

| Automated tax support available | Direct support challenges |

| Affordable core product | Limited HR integrations |

What are some of QuickBooks’s Payroll greatest strengths?

Intuit developers consider everything while they continually upgrade QuickBooks Payroll. They consider everchanging businesses payroll needs as well as the evolving needs of the users. Upgrades are also thoughtful and responsive to the demands of the day-to-day users who use payroll services. It has the R&D resources to stay ahead of the market’s needs to best support its customers. In short, Intuit strives to provide leading financial products within an increasingly competitive market.

What makes QuickBooks Payroll unique?

The payroll solution is simple to use because it walks you through the setup and basic processes. There is little guesswork to using the software. It even provides check-off lists to show your progress regarding certain tasks, such as adding an employee or setting up benefits.

How simple the product is to use gives the user confidence in that they are doing things right and that the outcome will be correct. When you first start using QuickBooks Payroll, you’ll find it intuitive to use. If you need to import a large volume of employee data, you can request help to set up the software correctly.

What makes QuickBooks Payroll a top payroll service provider?

QuickBooks Payroll is easy to use, and it works directly with QuickBooks Online accounting plans. If your business already uses QuickBooks Online, it only takes a few seconds to add this payroll service and only a few minutes more to be up and running.

In addition to ease of use and QuickBooks compatibility, it is also affordable and functional. The introductory plan starts at only $45 per month with unlimited payroll. And every plan includes the “full-service payroll” features, including unlimited payroll, deduction and tax calculations, automated tax forms, an employee mobile portal, and reporting tools.

What integrations does QuickBooks Payroll offer?

QuickBooks integrates with over 650 business solutions. However, those integrations may be to QuickBooks accounting solutions and not directly with the payroll service. If you also use the QuickBooks accounting solution, you’ll find these integrations helpful.

Intuit developer tools are available if you need to create custom integrations.

Here is a list of a few of the most popular business app integrations:

Time tracking

- Boomr

- Deputy

- Harvest

- Homebase

- MinuteWorx

- On the Clock

- Timesheet Mobile GPS

- com

- TMetric

- VeriClock

Human resources

- EverythingHR

- Justworks

- Zenefits

- Zoho People

Expense tracking

- Abacus

- Bento

- Concur

- Expensify

- Minute7

- Shoeboxed

- Shopify

- Tallie

- TripLog

- Veryfi

- Zoho

Benefits

- GoBenefits

- Guideline 401(k)

- Human Interest

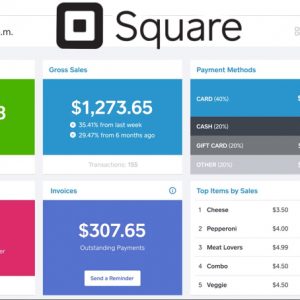

Point of Sale

- Cin7

- Hike

- Lightspeed

- SalesVu

- Shogo

- ShopKeep

- Square

- TouchPoint

- Vend

Other payroll products

- ADP Run

- Gusto

- Patriot

- Paychex

- Square

- SurePayroll

- Wagepoint

Does QuickBooks Payroll offer data migration from other providers?

Data migration support is available. The level of service depends on the plan. QuickBooks Payroll Core customers do not receive migration support. Premium plan subscribers have to import data themselves, but Intuit will help with the QA process to ensure data is transferred and set up correctly. Elite plan customers receive full migration support. Your accountant should also be able to help you set up payroll correctly.

What is QuickBooks Payroll security and reliability?

Since QuickBooks processes sensitive personal and financial information, security is a top priority for Intuit. Security protocols in place include physical security, data protection, data backup, and access control.

Specific security practices include:

- 24/7/365 physical server security

- Server power backup

- Smoke, flood, and fire monitors

- VeriSign SecuredTM, 128-bit SSL

- Firewall protected servers

- Multi redundant backup

- Comprehensive privacy policies

- TRUSTe Privacy Program licensee

- 8 percent uptime

- Access controls

- Security audits

- Updated Terms of Service

QuickBooks Payroll financial position

Last year, 2020, it reported $7.7 billion in revenue and employed over 10K people in nine countries. Efforts to increase support for small businesses and the self-employed resulted in 15 percent revenue growth in this vertical last year. Growth is continuing to appear in this market in 2021.

Resources about QuickBooks Payroll

- QuickBooks Resource Center

- The QuickBooks Blog and Intuit Blog

- Access developer tools for creating integrations

- QuickBooks Payroll Terms of Service

- Detailed information about QuickBooks Payroll Pricing

- Information for accountants and bookkeepers

- Intuit press room and press releases

- Intuit’s security information

- Small Business help and payroll tips

For more information about QuickBooks Payroll

The easiest way to learn more about QuickBooks Payroll is to review its payroll plan pages. You can also contact sales by calling 1-877-202-0537 (Monday-Friday 5 am – 6 pm or Saturday-Sunday 7 am – 4 pm PST), or if you need help picking a plan, you can call 1-888-537-7793.

If your business already uses QuickBooks Online, you can simply add the payroll plan of your choice to your account. When logged in, you can access additional support options and resources, such as the QuickBooks Community. When logged in, you can also contact Intuit by chat or schedule a telephone call.

Specification: Intuit Payroll Review

| How other 3rd Party Experts Rank each product (Bronze, Silver, Gold) | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||

| Price | ||||||||||||||||||||

|

||||||||||||||||||||

| Customer Service | ||||||||||||||||||||

|

||||||||||||||||||||

| Payroll Standard Features | ||||||||||||||||||||

|

||||||||||||||||||||

| Payroll Add on Features | ||||||||||||||||||||

|

||||||||||||||||||||

| Reporting | ||||||||||||||||||||

|

||||||||||||||||||||

G2 Reviews –

Here is a summary of the user reviews that people found most helpful. They were voted as most helpful for both positive and negative reviews out of the 494 available to read on G2 Reviews.

Most helpful: Positive Review (full review) Most helpful: Negative Review (full review)

Capterra Reviews –

Here is a summary of the user reviews that people found most helpful. They were voted as most helpful for both positive and negative reviews out of the 494 available to read on Capterra Reviews.

Most helpful: Positive Review (full review) Most helpful: Negative Review (full review)

Software Advice –

Here is a summary of the user reviews that people found most helpful. They were voted as most helpful for both positive and negative reviews out of the 494 available to read on Software Advice Reviews.

Most helpful: Positive Review (full review) Most helpful: Negative Review (full review)