ADP Payroll Review

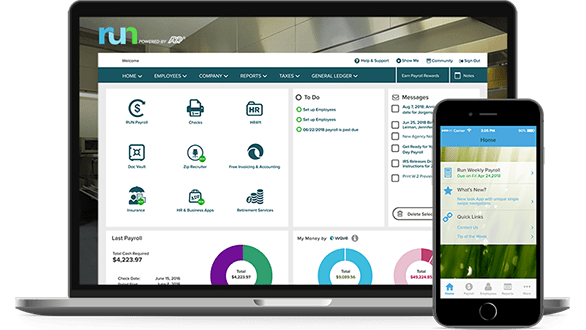

While the program maybe difficult to learn, once you master how ADP Enhance Payroll’s ADP RUN works, you will never have to think about payroll or taxes again.

$25.00

ADP Run Payroll Service: A Leading Global Payment Processor

ADP Run is one of the top payroll services in the US. Most employees within the US have received a payroll payment via ADP at least once during their careers. Its biggest competitor is Paychex. ADP supports about 900K clients, whereas Paychex supports nearly 700K.

If you lead a growing company looking for a payroll solution that can help you quickly scale, ADP should be added to your list of prospects. While it offers plans for small operations, it is particularly suited to larger operations. It is not out of ADP’s range to process thousands of payroll checks across multiple locations. It even offers PEO services if needed.

As your company grows, you can add additional ADP services such as talent management and HR services. Its talent management services support recruiting, hiring, and onboarding. HR services include an HR helpdesk, form and document support, and HR process support.

What is a Payroll Service?

Payroll services help companies accurately process payroll. It relieves small business owners or accounting teams of the burden of calculating payroll taxes, deductions, and garnishments. The services also process direct deposit, check, and pay card payments.

Most payroll solutions connect with other business software such as time-tracking, accounting, or HR systems to help process payroll. Some also provide healthcare, retirement, and workers’ compensation support.

Some online payroll services configure tax payments and file and pay employment taxes for businesses automatically. Helping keep businesses tax-complaint is a considerable benefit and well worth the cost of payroll services. Some offer tax configuration guarantees to protect companies should it miscalculate tax payments.

Most basic payroll services include the following features:

- Payroll processing for W-2 and 1099 workers

- Check and direct deposit payroll payments

- Employee tax configuring and reporting

- Tax filing support (may cost extra)

- Benefits withholding

- Mobile employee self-service tools

- Reporting tools

- Garnishment deductions

- Time and schedule tracking (may cost extra)

- Tax and employment law compliance support

What businesses are best served by ADP?

ADP offers four payroll plans to support businesses of all sizes. It provides options for startups as well as enterprise-sized operations. Unlike many payroll services, ADP is suitable for most businesses, including those that need to process payroll for employees, contract workers, commission-based employees, and tipped workers.

That said, ADP, unlike many payroll services, can handle large contracts with companies with thousands of employees, making it ideal for large and growing operations.

ADP also offers Professional Employer Organization (PEO) services. This is a helpful service for small companies without an in-house HR team or companies needing help managing employees in remote or global offices. ADP’s PEO services help with payroll, Workers’ compensation, benefits, and HR.

In terms of industries served, ADP reports to support:

- Restaurants and hospitality

- Professional services

- Manufacturing

- Financial services

- Construction

- Retail

- Healthcare

- Government

- Education

- Nonprofits

- Social services

What services does ADP offer?

ADP offers four payroll processing plans and time and attendance, HR outsourcing, benefits, and talent management services. The payroll processing service powered by ADP is called Run. ADP does not publish pricing. You have to request a quote to obtain customized pricing information.

ADP charges per payroll run, which can add up if you process payroll weekly. Some services, such as time and attendance, require an additional monthly fee.

ADP Run plans and features

Essential Payroll:

- Payroll processing

- Direct deposit, check, and debit card payments

- Employee portal

- General ledger interface

- New hire onboarding support

- Reporting tools

- Tax filing

- W-2 and 1099 support

Enhanced Payroll:

Essential features plus,

- Background checks

- Check signing security

- State unemployment support

- ZipRecruiter

Complete Payroll:

Enhanced features plus,

- Employee handbook help

- HR forms and documents

- HR helpdesk

- HR tracking

HR Pro:

Complete features plus,

- Employer and employee training

- Enhanced employee handbook support

- Enhanced helpdesk support

- Google Ads support

- Legal assistance

- Marketing tools

- Sexual harassment prevention training

Available add-ons:

- Healthcare, retirement, and Workers’ compensation

- Small business marketing toolkit

- Time and attendance tracking

ADP Features and Benefits

ADP’s payroll service called Run provides payroll processing services that work with ADPs other products such as time tracking, HR services, talent management, and benefit offerings.

Payroll processing

ADP Run provides all basic payroll processing features such as processing payroll for hourly, salary, commissioned, tipped, and 1099 workers. Wages are paid by check, debit card, or direct deposit. It automatically configures deductions such as benefits, retirement contributions, and garnishments.

Tax support

This payroll solution calculates, files, and pays required local, state, and federal employment taxes. ADP keeps you informed of tax law changes for you, and all account managers are required to have a minimum of eight years of tax and ADP experience. If desired, ADP can be contracted to respond to tax agency notices for you.

Business solution integrations

Integrations help businesses significantly save time and improve payroll accuracy. ADP provides integrations with other popular business solutions such as accounting, HR, time tracking, ERP, and benefits services. Developer tools are available to create custom integrations.

Time and attendance tracking (costs extra)

ADP’s time and attendance service fully integrates with the payroll solution. If you need to track hourly workers, complex schedules, and approvals, the time and attendance tools could be a helpful addition. Employees can check-in/-out via the mobile app, and managers can publish schedules online. Managers can also track time-off requests and approvals using remote logins. These time tracking tools are valuable for businesses that track hourly workers, such as restaurants, retail stores, or construction companies.

Advanced reporting tools

ADP provides preconfigured and custom reporting options. Reporting categories include employee, payroll, deductions, and PTO reports. Specific reports include pay rate, Workers’ compensation, health benefits, PTO balances, earnings, employee lists, and more. Reports can be sorted and filtered in various ways, including by custom start and end dates. Completed reports can be saved and shared as a PDF, CSV, or Excel file.

ADP Pros and Cons

Reviewing the pros and cons of a payroll service can help you quickly identify features of interest or cons that may be a concern. For the most part, ADP receives positive remarks from clients, and it’s a good option for large or growing companies. Small operations may honestly be happy with a lower-priced payroll option if payroll and HR needs are minimal.

| ADP Pros | ADP Cons |

| Simple tax filing | Charges per payroll run |

| Easy to use | Additional fees add up quickly |

| Scalable | Limited instant support |

What are some of ADP greatest strengths?

ADP provides two great strengths: ease of use and scalability. This service helps businesses streamline payroll processing tasks, and once set up, it pretty much automatically runs payroll. There is no limit on how large a company ADP supports. While some payroll services focus on small businesses, ADP can support large enterprise-level companies with thousands of employees.

Ease of use

ADP payroll is simple to use, and employee and employer onboarding tools help speed up adoption rates.

ADP features that help companies process payroll easily

- Automated deduction and garnishment processing

- Automated payroll payments

- Automated tax calculations and payments

- Business software integrations

- Employee onboarding

- Online and mobile manager and employee apps

- Quarterly tax payments

- Tax form support

- Time and attendance tracking and reporting

- Unemployment insurance management

ADP Run scalability

ADP Run helps businesses process payroll for 40 million workers. For large clients, it provides a complete Human Capital Management (HCM) platform along with payroll processing. This platform is designed to help large operations manage over 1000 employees.

The HCM provides tools small operations may not require, such as

- Advanced AI and analytics

- Advanced reporting and insights

- Complex org charts and team support

- Global compliance support

- Global payroll processing

- Integrated dashboards

- Localized benefits

- Online and mobile apps

- Recruiting and hiring support

- Workforce management

What makes ADP unique?

It may seem simple, but ADP is a good partner for growing and large companies, which is anything but simple. Smaller payroll services do not have the experience or expertise to handle enterprise-sized company’s payroll and HR needs. Imagine trying to get a payroll solution built for small companies and startups to handle payroll needs for 10,000 employees. Try as they might. It is most likely not possible. ADP has the experience, advanced tools, and professional expertise to help large operations process payroll for thousands.

What makes ADP a top payroll service provider?

ADP is a leading payroll service provider due to its experience and ability to support large operations. The HR company was founded over 70 years ago and now supports over 900,000 clients in 140 countries.

Companies looking to scale will benefit from partnering with ADP. This payroll and HR company provides the tools necessary for companies to keep abreast of evolving HR issues while also satisfying varying payroll needs. It has nearly 20 offices located worldwide to support global clients.

What integrations does ADP offer?

ADP is one of the most popular payroll solutions in the US, so it has to integrate with other popular business solutions to serve its customer’s needs best. To supports its customers, it offers a long list of integrations in the ADP Marketplace. Developer tools are also available for creating custom integrations.

Popular ADP integrations include,

- Accounting software: QuickBooks, Wave, and Xero

- Enterprise Resource Planning (ERP): Workday, SAP, Sage, and Oracle

- Time and attendance: Depute, QB Time, Replicon, and When I Work

- Recruiting and onboarding: GoodHire, ZipRecruiter, Lever, Sapling, and JazzHR

- Learning management (LMS): Cornerstone. SAP Litmos, Brainier, and Absorb LMS

- Benefits administration: Flock, PlanSource, Decisely, and Employee Navigator

- Employee benefits: PayActiv, HealthEquity, and LifeMart

- Collaboration and productivity: Microsoft Teams, Slack, Pingboard, and signNow

- Point of sale (POS): Revel, Toast, Upserve, Micros, and POSitouch

Does ADP offer data migration from other providers?

Small operations can easily import employee and company data into ADP. Large companies can employ ADP via FosterThomas to perform professional implementation services. This is a paid service. How long the process takes depends on the resources available, resources required, and the volume of data needed to be transferred.

Managed implementation services include:

- Compliance and change management

- Data conversion, testing and validation

- Modeling and configuration

- Payroll Administration, interim or long-term basis

- Procedural development and customized training

- Process optimization

- Project management

What is ADP’s security and reliability?

ADP manages financial, employee, and proprietary company data, so it’s necessary for it to maintain a high level of security. To help secure data, ADP is SOC 1 Type 2, SOC 2 Type 2, Sarbanes-Oxley, PCI DSS, ISO 9001:2015, and ISO 27001:2013 certified.

Additionally, ADP provides the following protections:

- Employee training

- Fraud protection

- 24-hour global protection

- Incident management

- Onsite physical security

- Client security education

- Threat monitoring

- Third party audits

- Risk management

- Privacy compliance programs and reviews

- GDPR compliant

ADP’s financial position

ADP is a publicly traded company (NASDAQ: ADP) headquartered in Roseland, New Jersey. This payroll service was founded in 1949 and reported $14.6 billion of revenue in 2020.

It is a large company with nearly 60,000 employees. ADP provides services in 140 countries and supports 900K clients worldwide. Clients use ADP services to process payroll for almost 37 million workers. One in six workers in the US are paid using ADP payroll services.

ADP was named FORTUNE Magazine’s “World’s Most Admired Companies®” list for 14 consecutive years. You can see more of ADP’s awards here.

Resources about ADP

ADP publishes a wide range of product information online. It also makes accessible information about its security, privacy policies, and terms.

- ADP business tools such as calculators, glossaries, tax guides, and tax forms

- ADP case studies and testimonials

- Awards and recognitions

- Compare ADP plans

- COVID-19 resources and Employer Preparedness Toolkit

- Find integrations in the ADP App Marketplace

- Resources for accountants

- Resources for midsized and enterprise businesses including insights and guidebooks

- Resources for small businesses including articles and FAQs

- Review ADP’s data security protocols

- Terms and conditions

- The ADP Spark Blog

- Watch and sign up for a webinar or event

For more information about ADP

You can receive a quick response from ADP by telephone or online form. To learn more about ADP payroll services and to request a quote, call 1-855-660-0544. You can also start a quote by submitting an online form. When we submitted our query, we received an email from a representative within a day.

To contact support, call 1-844-227-5237. Current clients can also contact support via the online portal.

Specification: ADP Payroll Review

| How other 3rd Party Experts Rank each product (Bronze, Silver, Gold) | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||

| Price | ||||||||||||||||||||

|

||||||||||||||||||||

| Customer Service | ||||||||||||||||||||

|

||||||||||||||||||||

| Payroll Standard Features | ||||||||||||||||||||

|

||||||||||||||||||||

| Payroll Add on Features | ||||||||||||||||||||

|

||||||||||||||||||||

| Reporting | ||||||||||||||||||||

|

||||||||||||||||||||

Capterra Reviews –

Here is a summary of the user reviews that people found most helpful. They were voted as most helpful for both positive and negative reviews out of the 70 available to read on Capterra Reviews.

Most helpful: Positive Review (full review) Most helpful: Negative Review (full review)

Software Advice –

Overall Rating 4.4 (5,093 Total Reviews) as of August 26, 2021

Here is a summary of the user reviews that people found most helpful. They were voted as most helpful for both positive and negative reviews out of the 5,093 available to read on Software Advice Reviews.

Most helpful: Positive Review (full review) Most helpful: Negative Review (full review)

G2 Reviews –

Here is a summary of the user reviews that people found most helpful. They were voted as most helpful for both positive and negative reviews out of the 164 available to read on G2 Reviews.

Most helpful: Positive Review (full review) Most helpful: Negative Review (full review)