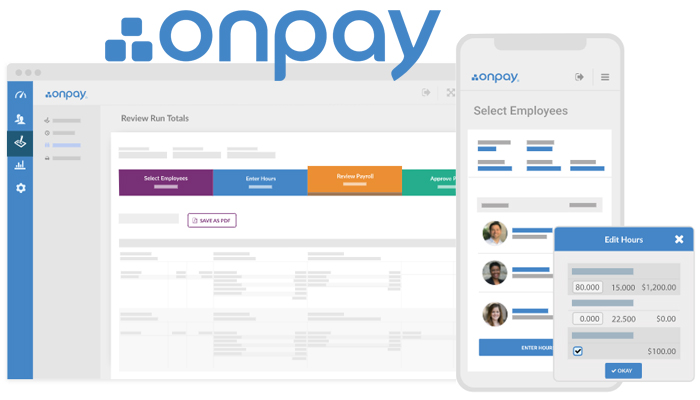

Onpay Payroll Review

OnPay online payroll service is, without question, a strong payroll program for small business owners.

$36.00

Is OnPay a Top Online Payroll Service?

Whether you have five employees or 50, processing payroll is a challenge and time-consuming. And you can’t mess up, and it always has to be on time. Your employees depend on you. OnPay helps small and medium organizations process payroll quickly and accurately.

One of the reasons OnPay payroll services hit the top of our list is that it is an affordable and capable product available at a low monthly rate with no hidden fees. OnPay doesn’t even charge for setup and data migration. In addition, it includes free HR tools.

If you have 20 employees or contract workers to pay, OnPay only costs $116 per month for unlimited payroll runs. That means you can pay weekly, every other week, or on-demand for the same monthly fee. This fee includes direct deposit payments, which is preferred by most employees and employers.

For the low monthly rate, OnPay also calculates, pays, and files employment taxes. Many services cost more for filing and payments. The only slight inconvenience is entering your local and state tax rates into the system. But for the cost, this is a minor hassle. Once you are set up, payroll is processed automatically, and your employees are quickly paid on-time.

What is a Payroll Service?

Payroll services help automate tedious (but essential) payroll processes. Payroll solutions support HR and accounting teams, giving them more time to manage other tasks while also increasing payroll accuracy.

These services process tasks including managing taxes, configuring deductions, monitoring compliance, processing varying pay rates, creating payroll reports, tracking time and schedules, and calculating benefit payments. Of course, it also processes payroll and sends out employee payroll payments.

- Compliance support: Tax, employment laws

- Mobile app: Managers, employees

- Payroll calculations: Hourly, salary, contract workers

- Payroll payments: Paper check, direct deposit, debit card

- Reporting: Tax, employee, job costing, custom

- Tax assistance: Calculating, filing, reporting

- Time tracking: Hours worked, locations, schedules

- Withholding: Taxes, deductions, garnishments, benefits

What businesses are best served by OnPay?

Since OnPay provides a handy bundle of payroll, HR, and benefits, it is most suitable for smaller operations. Additionally, it integrates with accounting software often used by small companies such as Xero and QuickBooks Online.

One of its largest customer groups is dental practices. However, it also provides tools to help process payroll for tipped workers, non-profits, farms, churches, and law firms. This payroll processor is a good fit unless the company is large and requires an advanced accounting solution like NetSuite or a complex human resource solution such as Workday.

Small businesses will also appreciate the straightforward pricing. With OnPay, you can get payroll processing and HR features for one low monthly price. The base fee is only $36 plus $4 per month for each person paid. So, a company of only ten employees can process unlimited payroll for only $76 per month. Compared to manually processing payroll, this payroll solution will earn its ROI in the first month.

What services does OnPay offer?

OnPay provides a full-service payroll solution. It also offers a human resources solution and benefit plans. To help companies save money, it supports unlimited payroll runs at no additional cost. And its HR features are also available with no additional fee.

OnPay payroll services: $36 plus $4 per employee per month:

- Unlimited payroll runs

- Calculates deductions and garnishments

- Custom reporting

- Employee and contract workers

- Employee self-onboarding

- Integrates with accounting and time tracking software

- Mobile tools

- Pay by direct deposit, check, or debit card

- Payroll available in 50 states

- Single sign-on support

- Supports multiple rates and schedules

- Tax filing and payments

- Withholds unemployment insurance

Human resources software: No additional fee

- Document storage

- Employment offer letter tracking

- Employee self-onboarding

- HR audits

- HR templates and esigning

- In-app messaging

- Org charts and directories

- PTO tracking and approvals

Benefits: Pay per benefit per person

- Commuter benefits

- Dental insurance

- FSA

- HSA

- Health insurance

- Life and disability insurance

- Parental leave

- Retirement plans

- Vision insurance

- Worker’s compensation

OnPay Features and Benefits

OnPay’s payroll service includes payroll processing, tax calculations and payments, basic HR tools, PTO tracking, and implementation support. Most services are included with the essential payroll plan and do not incur additional fees. If desired, you can add benefit and retirement plans.

Payroll processing

OnPay processes payroll for hourly, salary, contract, and tipped workers. It can even manage varying pay rates and pay schedules (for example, if you pay your hourly workers weekly but your salary employees twice per month). It pays employees by direct deposit or debit card at no additional cost. If you pay by check, it charges a small fee.

To help create accurate payroll, it calculates a variety of deductions and payments. It processes deductions for taxes, benefits, garnishments, unemployment withholdings, and specialized deductions (gym memberships, wellness plans, daycare). Deductions are clearly communicated to employees on their paystubs.

Unlimited payroll runs

If you run payroll weekly, this feature can save your company quite a bit of money. For example, paying 100 people per month simply costs $436 whether you pay weekly, every other week, or twice per month. Additionally, if you process an extra payroll run for a holiday bonus, it is still the same monthly fee.

Tax calculations, filing, and payments

Unlike many payroll services, OnPay includes this service as part of the basic monthly plan. It will calculate your tax obligations, make payments, and file Form 941 quarterly and Form 940 yearly for you. If a calculation error is made, it provides an Accuracy Guarantee to help cover any of your losses or interactions with the IRS.

Time tracking and scheduling

OnPay integrates with time tracking and scheduling software to help you process payroll accurately. It pulls data from software such as Deputy and When I Work to process payroll. Using data from these services, it can process payroll for complex schedules.

Regarding PTO, it can help manage customized time-off policies, accruals, time-off requests, approvals, and calendars. If you have employees with different accrual schedules, it can support up to three different accrual types.

HR tools

This online payroll service includes basic HR tools for free. This is a valuable inclusion for small businesses with minimal HR resources. OnPay provides automated HR tools such as self-service employee onboarding, esigning and document storage, online tax forms, compliance audits, and online offer letters. These tools help streamline the hiring and onboarding process and help manage employees after onboarding.

To help keep teams organized and transparent, it creates visual org charts and employee directories. Employee profiles include basic information such as location, team, department, and contact information. You can make the directory searchable and accessible to all employees.

Reporting

You can choose from a large selection of premade reports, or you can configure custom reports using OnPay. Reports include payroll register, earning summaries, employee summaries, payroll summaries, accrual, and retirement reports. Over 50 data points are available to be quickly sorted and filtered.

It includes a report designer for creating visually appealing reports using custom views. You can share reports via PDF, spreadsheet, or you can export reports to your accounting software.

Employee tools

Self-service employee tools help save HR time and resources. OnPay supports employee self-onboarding, so HR persons do not have to spend their time entering basic information into the system, such as contact information and tax status. Via the employee portal, employees can access pay stubs, employment documents, and common tax forms. They can also adjust their voluntary deductions, such as retirement plan contributions.

OnPay supports “lifetime accounts,” which means former employees or contractors can access their pay stubs and tax information without contacting HR, forever.

Integrations

OnPay provides what they call “deep software integrations” with popular accounting and time tracking software. What might be considered a “shallow” integration usually shares just a few data sets. More complex integrations or “full” integrations can transfer more data sets than a simple integration. OnPay offers “deep” integration with QuickBooks, Xero, Deputy, When I Work, and Humanity.

Setup and Migration

OnPay provides free setup and migration services. You are only required to enter a bit of basic information, such as your business data. Then OnPay will migrate data sets such as employee information, pay rates, and payment histories. Many payroll services charge for setup and migration support, so this is a budget-friendly offering.

Benefits (optional)

Benefits are not offered for free, but OnPay does provide a choice of benefits suitable for small to medium businesses. Fees for benefits vary. Compatible benefits include retirement plans, health insurance, life, and disability insurance, and health insurance (medical, optical, dental). It can also manage deductions for unique benefits such as commuter benefits.

OnPay Pros and Cons

Quickly reviewing the pros and cons of OnPay can help you decide if it is a payroll service you’d like to check out further. For the most part, OnPay provides features attractive to smaller operations. Cons are minimal, but if they matter to you, it is worth thinking about.

| OnPay Pros | OnPay Cons |

| Unlimited payroll runs | No abbreviated mobile app |

| HR features included | Manual state setup |

| Tax filing | No 24/7 support |

What makes OnPay unique?

One of the unique aspects of OnPay is the flat-rate pricing that includes unlimited payroll, tax payments, and essential HR tools. While a few popular payroll processors offer flat pricing, most charge extra for HR tools and may even charge extra for tax payments. OnPay has done a good job of creating an affordable plan for small and medium-sized businesses and those on a restrictive budget, such as non-profits, churches, and farms.

What makes OnPay a top payroll service provider?

Besides its affordable payroll processing plans, it is also simple to use. OnPay is a top online payroll service because it does what it needs to do, which is help businesses process payroll easily and accurately. Most customers report that they could quickly set up and run payroll with minimal need for assistance. While support is not available 24/7, customer support is knowledgeable and helpful when help is needed.

What integrations does OnPay offer?

OnPay integrates with accounting, time tracking, 401(k), HR, and financial services. OnPay is a certified app partner with Xero accounting software. This integration automatically adds payroll transactions to the accounting software.

Other OnPay integrations include,

- Accounting software: QuickBooks Online, QuickBooks Desktop

- Time tracking: QuickBooks Time (TSheets), When I Work, Deputy, Humanity

- Retirement: Guideline, America’s Best 401k, Vestwell

- HR: Mineral (Think HR), PosterElite

- Financial services: Kabbage, Magnify

Does OnPay offer data migration from other providers?

OnPay provides migration services for new customers. All you have to do is enter basic company information, and then OnPay will set up the migration of employee data and wage history. Data migration is a quick process that can even be done during busy times. OnPay also provides support for connecting accounting and time tracking software.

What is OnPay‘s security and reliability?

Like most payroll providers, OnPay manages sensitive information that must be protected onsite and “in flight.” It also supports an extensive list of privacy policies.

To protect data, it employs SSL high-grade encryption (AES-256), provides 24/7 onsite data facility security, redundant backup, onsite encryption, and controls access. Data centers are located in Atlanta, Georgia, and Tampa, Florida.

OnPay collects personally identifiable and non-personally identifiable information. Personally-identifiable information such as names, social security numbers, bank information, and tax statuses are fully protected and only used to provide services. Non-personally identifiable information such as demographic information, how services are used, and IP addresses may be used to improve services or to provide tailored services.

OnPay’s financial position

OnPay, Inc. is a privately held company located in the Ponce City Market area alongside other tech companies such as HowStuffWorks and MailChimp in Atlanta, Georgia. In January of 2020, it completed a $6 million Series A funding round. Currently, it supports over 10,000 US-based clients and processes over $2 billion in payroll annually.

Jesse Burgess is the founder and CEO of OnPay. When asked about the funding, he said, “With this funding, we will continue to scale and exceed the expectations of our clients, while focusing on innovative product-led development.” Part of the scaling efforts will include hiring, increasing marketing, and improving the customer experience.

Resources about OnPay

- Discover the latest news release from OnPay by visiting News & Press

- OnPay publishes client stories on its website

- Learn about how OnPay was founded

- The Help Center provides product and topic training

- Information for accountants and bookkeepers

- OnPay monthly fee calculator

- Full list of integrations

For more information about OnPay

It is easy to contract OnPay. If you’d like to learn more about this online payroll service, call 877-328-6505 anytime between 9 am and 8 pm ET Monday through Friday. Or you can email the customer experience team via hello@onpay.com (email support starts at 7 am). If you are in no hurry, you can send a letter to 1230 Peachtree Street NE, Suite 250, Atlanta, Georgie 30309.

Logged-in customers can contact support by chat from 9 am to 8 pm ET Monday through Friday.

Of course, you can also request a demo or account representative email by submitting basic information into an online form.

Specification: Onpay Payroll Review

| How other 3rd Party Experts Rank each product (Bronze, Silver, Gold) | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||

| Price | ||||||||||||||||||||

|

||||||||||||||||||||

| Customer Service | ||||||||||||||||||||

|

||||||||||||||||||||

| Payroll Standard Features | ||||||||||||||||||||

|

||||||||||||||||||||

| Payroll Add on Features | ||||||||||||||||||||

|

||||||||||||||||||||

| Reporting | ||||||||||||||||||||

|

||||||||||||||||||||

G2 Reviews –

Overall Rating 4.9 (168 Total Reviews) as of August 25, 2021

Here is a summary of the user reviews that people found most helpful. They were voted as most helpful for both positive and negative reviews out of the 168 available to read on G2 Reviews.

Most helpful: Positive Review (full review) Most helpful: Negative Review (full review)

capterra reviews –

Here is a summary of the user reviews that people found most helpful. They were voted as most helpful for both positive and negative reviews out of the 331 available to read on Capterra Reviews.

Most helpful: Positive Review (full review) Most helpful: Negative Review (full review)

Software Advice –

Here is a summary of the user reviews that people found most helpful. They were voted as most helpful for both positive and negative reviews out of the 332 available to read on Software Advice Reviews.

Most helpful: Positive Review (full review) Most helpful: Negative Review (full review)