Paychex Payroll Review

The best part about Paychex is their 24/7 customer service support, which is quite rare considering even the best of the best payroll companies do not provide such service.

$39.00

Paychex payroll service: A payroll processing leader

Paychex is one of the top payroll processing companies in the US. We’d be surprised if you’ve never received a paycheck processed by Paychex, as nearly 10 percent of US private-sector workers are paid via Paychex. Why?

Because Paychex offers a complete payroll solution, even in its introductory plan, that is easy to use. It automatically processes payroll, deductions, tax payments, benefit payments, and more easily. It also provides HR, PEO, benefits, insurance, and retirement services if you need them.

This payroll processing service supports all types of employees, including contract workers and tipped employees. It even automatically processes employment tax payments to help your company stay compliant and ahead of your tax bills.

What is a Payroll Service?

Online payroll services help businesses process payroll. They automate functions such as calculating pay, managing PTO and holiday pay, configuring tax payments, and tracking time. The best support all workers, including hourly, salary, commissioned, tipped, and contract resources.

Payroll services like Paychex save HR and accounting teams time by automatically calculating current local, state, and federal employment taxes. Many will even automatically file and pay taxes for your company.

One of the main functions of payroll software is ensuring that your employees are paid accurately and on time. Using these services, you can pay employees and contract works by direct deposit, check, or debit card.

Basic payroll services:

- Benefits and retirement contribution withholding

- Employee mobile app and online dashboard

- Employee tax configuring and reporting

- Employee tax filing support

- Garnishment processing

- Check, direct deposit, or debit card payments

- Payroll processing for hourly, salary, tipped, and contract workers

- Report templates and custom reporting options

- Employment and tax law compliance support

- Time and attendance tracking

What businesses are best served by Paychex?

Paychex offers solutions for all business types, but it is most suited to growing and large operations. Small companies with just a handful of employees may be satisfied with a payroll service that supports unlimited payroll runs and includes basic HR and onboarding as included features.

However, larger operations with more advanced hiring and onboarding needs will benefit from the features provided by a top payroll provider such as Paychex. It is also a suitable payroll solution for companies with multiple offices or those requiring PEO services or international workers’ support. It is also a great product for accountants and other professionals who offer payroll services as part of their professional service offerings.

What services does Paychex offer?

Paychex offers three payroll packages: Go, Flex, and Flex Enterprise. All plans include basic online payroll features, admin tools, new hire help, and time tracking.

Paychex Go: $39 plus $5 per employee per month

- Online payroll

- Tax support

- Time tracking

- New hire support

- Basic reporting

- Accounting software integration

- Workers’ compensation insurance

- HR forms

- Direct deposit, check, and debit card payments

Paychex Flex Select: Customized pricing

Paychex Go plus:

- Mobile app

- Additional integrations

- Dedicated payroll specialist

- Employee wellness program

- Income verification services

Paychex Flex Enterprise: Customized pricing

Paychex Flex Select plus:

- State unemployment insurance support

- Advanced reporting and analytics

- Garnishment deductions and payments

- Onboarding support

- HR administration ongoing development support

Paychex Features and Benefits

Paychex includes every tool needed to process payroll, pay benefits, calculate deductions, make tax payments, pay employees, and build reports. To help process payroll accurately, it seamlessly imports data from time tracking and scheduling solutions. It also integrates with popular business software such as online accounting solutions. One of the reasons it hits the top of our list is that it is a complete payroll solution capable of supporting any business.

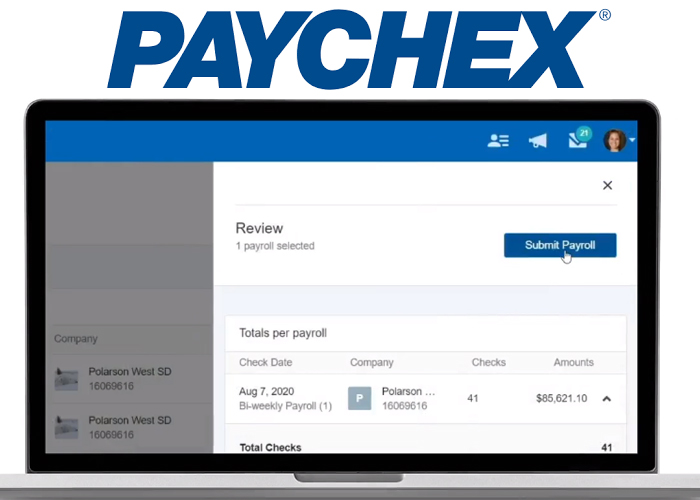

Online payroll processing

Paychex’s primary offering is online payroll processing. Payroll processing is Paychex’s main service, and they provide payroll services to suit the payroll needs of any size of company. All payroll plans include tax calculations and payments, direct deposit payroll payments, online employee tools, and tax/HR forms. More advanced plans come with access to a payroll specialist, employee training, and advanced reporting.

Using Paychex, you can process payroll utilizing a computer, tablet, or mobile phone. It processes payroll for all types of employees and contract workers. You can choose to pay payroll by check, debit card, or direct deposit. Paychex process all deductions for you so you can approve and run payroll within minutes.

Payroll tax support

This payroll service provides automated payroll tax services. Unlike some lower-ranked payroll products, Paychex keeps tax information up to date for you. You do not have to enter tax information such as state tax information to process payroll. The service stays on top of tax changes. It even files and pays employment taxes.

Paychex also searches for tax credits for you, including incentives such as Work Opportunity Tax Credit (WOTC), location-based, R&D credits, and others. You do not have to pay for this service unless Paychex finds credits for your business. It provides quarterly and annual tax credit reports.

Paychex offers full PEO services if you need help managing HR in additional locations.

Time tracking

Paychex tracks time using Paychex Flex Time or time tracking software of your choice. Paychex’s time tracking software fully integrates with its payroll software. It also integrates with third-party time tacking solutions. It supports web, mobile, and kiosk time clocks.

For extra security and to help prevent buddy punching, it supports facial, iris, and finger scan biometric logins. To help managers, it supports notifications, accruals, and approvals. Geolocation and geofencing tools also allow employers to track employee activities.

The scheduling tool comes with schedule templates and supports complex scheduling such as by capacity and availability. To ease manager’s day-to-day scheduling burdens, it includes automated shift swapping and it manages overtime rules.

Integrations

While this payroll tool integrates best with other Paychex products, it also integrates with other popular business solutions. Popular integrations include the ability to work with QuickBooks, Xero, Indeed, and BambooHR. It is also compatible with many financial and healthcare products such as Ameritas, AIG, Cigna, Fidelity, Merrill Lynch, The Standard, United Healthcare, and Vanguard.

Reporting tools

The introductory plans include basic reporting, and the enterprise version has more advanced reporting tools. The Paychex Go and Flex Select plans include what they call “essential” payroll reports. Essential reports support payroll processing, whereas more advanced reporting options include supporting HR reports too. The Flex Enterprise version provides custom analytics and reporting with the ability to create visual reports for sharing and presentations.

Reports available include expense, job costing, attendance, project, general ledger, PPP loan, payroll summary reports, and many more, plus customized reports. You can apply Boolean logic filters to advanced reports.

You can share reports via an Excel, CSV, or PDF file. Reports can also be viewed in a web browser.

Paychex Pros and Cons

Reviewing a product’s “pluses and minuses” helps you decide which payroll solutions may be worth your time to investigate further. Overall, the best features of Paychex include ease of use and the ability to accommodate growing companies. On the downside, which may be a concern for small operations, is that monthly fees can stack up quickly.

| Paychex Pros | Paychex Cons |

| Fast payroll processing | Does not provide unlimited payroll runs |

| Scalable | More costly than other services |

| Easy to use | Confusing reporting tools |

What makes Paychex unique?

Paychex is unique because it is truly scalable. You can use it when you start out with ten employees, and it will still accommodate your company when you have over 500 employees. As your company grows, you can add additional HR functions. If your company adds new offices, it can support you by processing payroll in all 50 states. PEO services are available if you need local, boots-on-the-ground HR support.

What makes Paychex a top payroll service provider?

There are a couple of things that make Paychex a top payroll service provider. We can start with ease of use. Most customers express that the software is simple to use even with minimal training. Second is the comprehensiveness of the payroll solution. Even the Go plan provides a complete payroll service that most report can be up and running within minutes.

What integrations does Paychex offer?

Paychex integrates with popular accounting solutions, HR systems, time and attendance software, and benefits programs. If you do not see an integration you require, you can build a connection using Paychex’s APIs.

Accounting software:

- AccountEdge

- Microsoft Dynamics

- NetSuite

- QuickBooks

- Sage

- Xero

HR and recruiting

- BambooHR

- Crew

- Glassdoor

- Indeed

- SimplyHired

Time and attendance

- Altametrics

- Clover

- HubWorks

- Insights360

- OnShift

Retirement and benefits

- Aetna

- AIG

- ABG

- Ameritas

- Betterment

- Charles Schwab

- Cigna

- Fidelity

- ING

- Liberty Mutual

- The Standard

- UnitedHealthcare

- Vanguard

This is just a partial list of integrations. See the full Paychex integrations list.

Does Paychex offer data migration from other providers?

Paychex offers data migration and setup support. You can supply them with pertinent business and employee information, and they will set up your new account for you. They can also pull data from other payroll systems if you are switching from another provider.

What is Paychex’s security and reliability?

Paychex employs a long list of security protocols to keep employee, company, and financial information secure. This payroll service provides physical and technology security, employee education, clear privacy policies, credential and login support, incident reporting, and vulnerability reporting.

Here is an abbreviated list of Paychex’s security protocols:

Employee training and security

Paychex employees are trained when hired and receive ongoing security training. They are trained to recognize, prevent, protect, and respond to security issues. Potential employees are also screened before being hired.

Physical and workplace security

Data centers and office locations are secured, and employees are trained to react to potential security challenges such as inclement weather and possible physical security weaknesses. Extra protection is provided for traveling employees, and data is secured when clients and vendors visit local offices.

Login and authentication protection

Paychex supports multi-factor authentications and supports biometric security practices if desired. All usernames, IDs, passwords, pictures, PINs are protected.

Privacy policy

You can find a detailed privacy policy published on the Paychex website. Personal information is protected and only used to provide services. Non-identifying information may be used to help improve services.

Vulnerability reporting and notifications

If you notice or suspect a vulnerability or unauthorized access, you can report unauthorized access by few methods, including via your local Paychex office. Paychex will investigate your concern and report back to you. If a security issue is discovered, it will create a security notification and report the incident to customers.

Paychex’s financial position

Paychex is a publicly traded company (NASDQ: PAYX) founded in 1971. It is headquartered in Rochester, New York, and has over 100 offices within the US and Europe. Paychex supports over 15,000 employees and 670,000 payroll customers. This payroll service holds a large market share and processes payroll for one in every 12 employees within the American private sector market.

Resources about Paychex

- Paychex’s Knowledge Center includes articles, whitepapers, and guides

- Helpful and up to date webinars

- Investor Relations

- News and press information

- Podcast: The Paychex HR Leadership Series

- Podcast: The Paychex Business Series

- Paychex developer tools

- Payroll and HR information for accountants

- Privacy and security information

- Client testimonials

- COVID-19 Help Center

- Small Business Employment Watch

For more information about Paychex

If you are looking for more information about how Paychex may be able to help your company process payroll, you can easily contact sales or support by telephone. Sales can be reached by calling 833-729-8200. You can call support by dialing 833-299-0168.

Current customers can access more support options when logged into their accounts. Support is also reachable by chat and email. 24/7 support options are available.

You can receive in-person support by visiting your local Paychex office location.

To help keep information secure, in most situations, employees are not authorized to interact with Paychex’s support team. Usually, the employer or administrator will need to contact Paychex.

Specification: Paychex Payroll Review

| How other 3rd Party Experts Rank each product (Bronze, Silver, Gold) | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||

| Price | ||||||||||||||||||||

|

||||||||||||||||||||

| Customer Service | ||||||||||||||||||||

|

||||||||||||||||||||

| Payroll Standard Features | ||||||||||||||||||||

|

||||||||||||||||||||

| Payroll Add on Features | ||||||||||||||||||||

|

||||||||||||||||||||

| Reporting | ||||||||||||||||||||

|

||||||||||||||||||||

G2 Reviews –

Here is a summary of the user reviews that people found most helpful. They were voted as most helpful for both positive and negative reviews out of the 1,262 available to read on G2 Reviews.

Most helpful: Positive Review (full review) Most helpful: Negative Review (full review

Capterra Reviews –

Here is a summary of the user reviews that people found most helpful. They were voted as most helpful for both positive and negative reviews out of the 1,067 available to read on Capterra Reviews.

Most helpful: Positive Review (full review) Most helpful: Negative Review (full review)

Software Advice Review –

Here is a summary of the user reviews that people found most helpful. They were voted as most helpful for both positive and negative reviews out of the 1,068 available to read on Software Advice Reviews.

Most helpful: Positive Review (full review) Most helpful: Negative Review (full review)