Types of Digital Payroll Services

The digital age has brought about two primary forms of payroll services. The first is online-only payroll services. These services are accessible through an online browser and don’t require you to personally download software. Instead, you can do everything by logging onto their internet portal an inputting your information. These type of services typically charge a monthly fee to conduct all of your payroll services for you.

The second type of digital payroll services is downloadable software payroll services. These services tend to be slightly more extensive, although recent developments have begun to close the gap. Your payroll manager will need to download this software to their computer to take advantage of their services. These types of services are typically licensed out for an annual fee.

Features

Online payroll services have a range of features that you won’t find with traditional payroll companies. It’s these unique features that have made them such an appealing option to many looking to get more out of their payroll division. We’ve outline some of the features that you should expect from an online payroll service. If these features aren’t offered, you may want to continue to look for other providers.

Easy-to-Use Interface

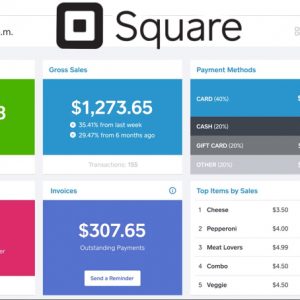

The interface of your payroll services should completely eliminate any complexity you may currently have with your payroll services. It’s very important that you’re able to use the software without having a background in payroll or computer science. Most modern payroll services have included tutorials that will give you a quick run-down of all the bells and whistles. If you feel like the software is too complicated, that’s because it probably is – don’t buy something that won’t save you effort and time.

Your online payroll services should allow you quick and easy access to everything. Make sure that the payroll service you choose provides you with clear and upfront access to all of your information.

Tech Support

One of the great advantages of purchasing licensed software is the additional tech support that comes along with it. This is great if you’re someone who finds it hard to use software. It also means if there are any additional problems you can get them fixed straight away. You should never overestimate the importance of having great tech support. Not being able to fix your payroll services in a crucial time can leave you out to dry.

Make sure that the company you’re working with has long tech support hours, if not 24/7. If you have a company that only provides e-mail support, or only answers the phone for a few hours a day, you might end up never having time to fix a problem. In addition, e-mail support can often be more of a hassle than it is worth. That’s why you should always make sure that tech support is as extensive as possible.

Form Generation

One of the most complicated things about bringing on new staff is generating forms and paperwork. You’ll need W-2s and 1099s for your employees, which can be awfully time consuming if you don’t know how to do it. Fortunately, form generation tackles all of this. Many of the software platforms will track all the information you have so that you can automatically generate forms when it’s time to give them to your employees. You no longer have to waste valuable hours compiling information when tax season comes along.

Secure and Organized Data Management

Keeping all your employees’ information is hard – you need a secure place to store tons of personal information. You have social security numbers, addresses, and other personal data that is dangerous in the wrong hands. Therefore, it’s on you to make sure that you’re storing your staff’s information responsibly. Not doing so is putting their livelihoods at risk and opening your business up to compensation or litigation.

In addition, it can be difficult to keep all this information organized, which can result in problems if you need to access it quickly. New payroll services software ensures the proper storage and management of this data, and allow you to access it quickly whenever you need to. It’s a more sophisticated version of data storage, and it saves you time, money, and potential problems down the line.

Organizes and Submits Taxes

When you’re a business owner, there is no shortage of taxes to consider. Payroll services make it easy to automatically sort and take care of your taxes. The type of taxes that should be included are payroll taxes, federal, local, and state taxes. You can set up your payroll account to automatically deduct these amounts and submit documentation and cash to the proper authorities. It means that tax season is way less of a headache than it used to be. One of the primary reasons that payroll has become so popular in recent years is tax simplification.

Account Synchronization

One of the features that is a must have for modern payroll services is the ability to synch with your various business accounts. Without this, there is no real benefit to paying for their software. By allowing these accounts to synch to your software you will find that everything happens much more seamlessly than it did in the past. Your bank accounts will automatically withdraw money to pay your employees and cover tax obligations. You’ll never have to write a check or do a manual transfer ever again – this makes payroll season a breeze.

Mobile Applications

Many modern payroll companies now have fully functional mobile applications that can help you improve your payroll capabilities. Instead of constantly having to have a computer on you, you can control most of your payroll services directly from your phone or tablet. Many of the applications you’ll find will have just as many capabilities as the desktop services. On top of this, they’re a great way to check in on the progress of certain payroll items, or double check the status of your accounts.

![]() Multiple Payment Methods

Multiple Payment Methods

Traditionally, employees are paid by their employers with a check or bank transfer. In recent years, bank transfer has become increasingly popular. But many other payroll services also allow other forms of payment which may be easier for some staff members. For example, some modern payroll software allows you to pay money directly onto a prepaid debit card. This can be more convenient for short-term employees. In addition, it means people can get their pay quickly if they don’t want to wait for a bank transfer (many can take up to 48 hours).

Off-Cycle Pay

Ask any former payroll employee, one of the hardest things about payroll is messing up a payment. Traditionally, you pay your employees either bi-weekly or monthly. If you mess up one of these payments, or miss one, it can end up costing you valuable time and money. Unfortunately, it’s often too hard to ask your staff member to wait for the next cycle. People have bills to pay and children to feed.

But off-cycle pay has become infinitely easier due to some of these new software platforms. You no longer have to worry about leaving staff out to dry. You can easily input a missed payment or emergency payment without having to go thorough, lengthy administrative processes. Making an off-cycle payment no longer has to be a massive head ache.

Bonus Pay

Just like off-cycle pay, bonus pay can be a bit of headache for employers when they need to pay a bonus to a staff member. Maybe you have annual bonuses or commissions included in your staff’s pay, or maybe you feel like rewarding an employee for recent performances, either way, it can be a nightmare with old payroll services.

Most new digital payroll service companies allow you to perform bonus payments with just the click of a button. You no longer have to worry about wanting to reward your employees – just head to the bonus section of your platform and pay your employee. The logistics will be worked out behind the scenes without you needing to worry.

Employee Access

A lot of your staff may want to have access to various parts of their platforms. They may want to know how much they’ve been paid, how much tax has been subtracted, and how long the current cycle is. Many new modern platforms allow your staff to have this additional access so they can see their own data.

Staff members will be able to view their own data without viewing the rest of the company’s information. This increases the transparency you have with staff members and reduces the chance that you’ll end up having to find information for them.

What Should I Expect to Pay?

So, you might be wondering what payroll services cost. Like all good things, most great payroll services come at a price. Payroll software’s traditionally license their product over a prolonged period of time, this is because they have to pay to help support and update the software throughout. If you do end up deciding to get payroll software, prices will vary depending on the company.

Different payroll services have different pricing structures. The average cost of payroll services will likely depend on the size of your business. Some will charge you a flat fee every month or year, while others will vary depending on how many staff you have. For example, many companies will charge you about $30-$40 per month, but then add an additional $5 per person. This means the smaller your company is, the less you’ll have to pay for the software.

I Only Have a Few Employees, are Payroll Services Right for Me?

Many people believe that because their business is rather small, they may not need payroll services, or they may not truly benefit from them. Perhaps having a few employees means that it is not worth the investment? This is very untrue. The smaller your business is, the more likely you are to benefit from payroll services. Modern software is very affordable, which means it’s not a drastic investment for a small business.

In fact, larger businesses have an easier time using traditional payroll methods because they have the time and money to invest in specialized staff. As a small business owner, you probably do most of these things yourself, or you have an employee that takes care of general administrative tasks. Wasting time with complex payroll methods has a much more substantial impact on your business than it would someone who owns a large company. In addition, by only having a few staff, it’s hard for you to specialize in general payroll tasks. Any change to your current set up could take weeks for you or your staff to fully understand.

That’s why we suggest that small companies take special advantage of these services – they’re definitely worth the price. In addition, as mentioned above, many of the pricing models ensure that you don’t have to pay as much if you have less staff. This is a great way to ensure that you’re only paying for a company the size of yours – the investment is minimal.

Benefits of Payroll Services

As you can see, there are a range of different features that are included in most payroll services that you sign up for. But, what benefits do you get from these extra features? Below we’ve outlined some of the key benefits that you’ll find included in payroll services.

- Won’t need an on-staff payroll specialist

- Won’t need to waste time conducting payroll on your own

- Won’t need to generate your own forms in tax season

- Won’t have to outsource to expensive third-party payroll company

- Will have full access to your own data

- Will have full control over your own data

- Will be able to implement more flexible payment techniques and schedules

- Will be able to provide world-class payroll benefits for a small price

- Won’t need to worry about keeping track of personal tax information

- Will have a safe and secure place to store staff information

- Will be able to focus more on the operations of your company

Don’t Be Scared to Expand Your Business

There will most likely come a time when it’s appropriate to expand your business. When this is will depend on your industry and resources. But many business owners are scared to take on additional staff or employees because of the head ache of payroll. This is no longer an issue if you find the right payroll service online. It means that you’re able to bring on extra people without having to waste hours doing administrative tasks.

In addition, it increases the flexibility you have to employ people for a short period of time or from other areas across the nation. For example, if you want to employ an individual who lives out-of-state, and you only need his services for a few hours a month, you can use an online payroll service to easily make this happen. Previously, the amount of paperwork and red tape would mean that hiring someone who lives out of state for only a few hours a month would be completely pointless.

![]() Multiple Payment Methods

Multiple Payment Methods